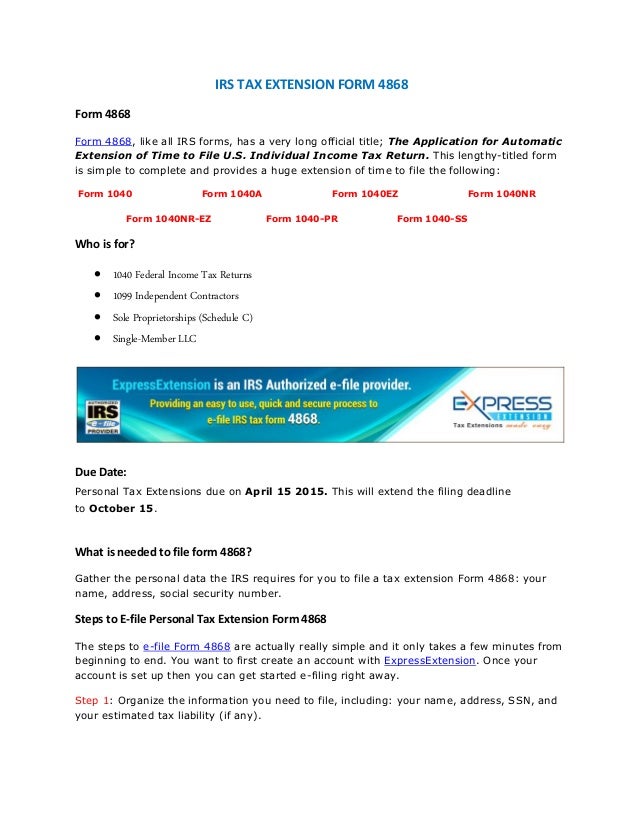

Once you’ve submitted the IRS extension form, it’s in your best interest to get moving on your taxes ASAP, because if you miss the extended Octodeadline, you’ll be on the hook for late filing penalties. Taxpayers can request an extension when they can’t pay taxes upfront or don’t have all of the necessary information to properly prepare their return. You don’t need to give a reason when you request an extension. However, taxpayers should keep in mind that they’re still subject to paying late payment penalties for paying their owed taxes after the deadline. If you’re unprepared to pay the taxes you owe, filing a Form 4868 allows you to file later without accruing late-file penalties as long as you file by the extended deadline. How Long Is a 4868 Extension?įorm 4868 offers you an automatic six-month extension to file your federal income tax return. Note: For 2019 taxes, the filing deadline is April 15, 2020. IRS Form 4868 does not absolve you from late tax payment penalties, but it does grant you extra time to file without incurring late filing penalties. IRS Form 4868 is the tax extension form that needs to be filed in order for the IRS to approve you to file your taxes after the filing deadline.

Find out how to file Form 4868 by clicking on the links below or read end to end for an in-depth overview of what to expect when you file for an extension. If your calendar has caught up to you, we’re here to help.īy filing IRS Form 4868, you can earn yourself a little extra time to file your annual federal tax return. But the months from January to April also signify a less exciting thing for Americans: tax season. The beginning of the year means new starts, clean slates, and excitement for the year ahead.

0 kommentar(er)

0 kommentar(er)